Gutters play a crucial role in protecting your home from water damage by directing rainwater away from the foundation. But what happens when your gutters are damaged? Will your homeowners insurance cover the cost of repairs or replacement?

If you live in Middlebury, Indiana, where storms, heavy winds, and snowfall are common, understanding your insurance policy’s coverage on gutter repairs is essential. In this guide, we’ll break down when insurance might cover gutter repairs, when it won’t, and what homeowners in Middlebury need to know.

When Does Insurance Cover Gutter Repairs?

Homeowners insurance may cover gutter repairs under specific circumstances. Generally, coverage applies if the damage is caused by a covered peril. A peril is an event or disaster listed in your insurance policy. Here are a few common scenarios where your policy might cover the repairs:

1. Storm Damage

If a severe storm, tornado, or hurricane damages your gutters, your insurance will likely cover the repairs. Since Middlebury experiences high winds and occasional severe weather, storm damage is one of the most common causes of gutter issues.

For example, if a strong windstorm rips your gutters off, your homeowners insurance should cover the replacement costs.

2. Fire or Other Natural Disasters

Fires and certain natural disasters like lightning strikes or hailstorms are typically covered by homeowners insurance. If a fire damages your roof and gutters, your insurance should pay for the repairs.

3. Tree Damage

If a tree branch falls on your gutters during a storm, your policy may cover the repair or gutter replacement costs. However, if the tree was dead or poorly maintained, your claim could be denied.

When Does Insurance Not Cover Gutter Repairs?

While insurance can cover some gutter repairs, there are several situations where you won’t be reimbursed:

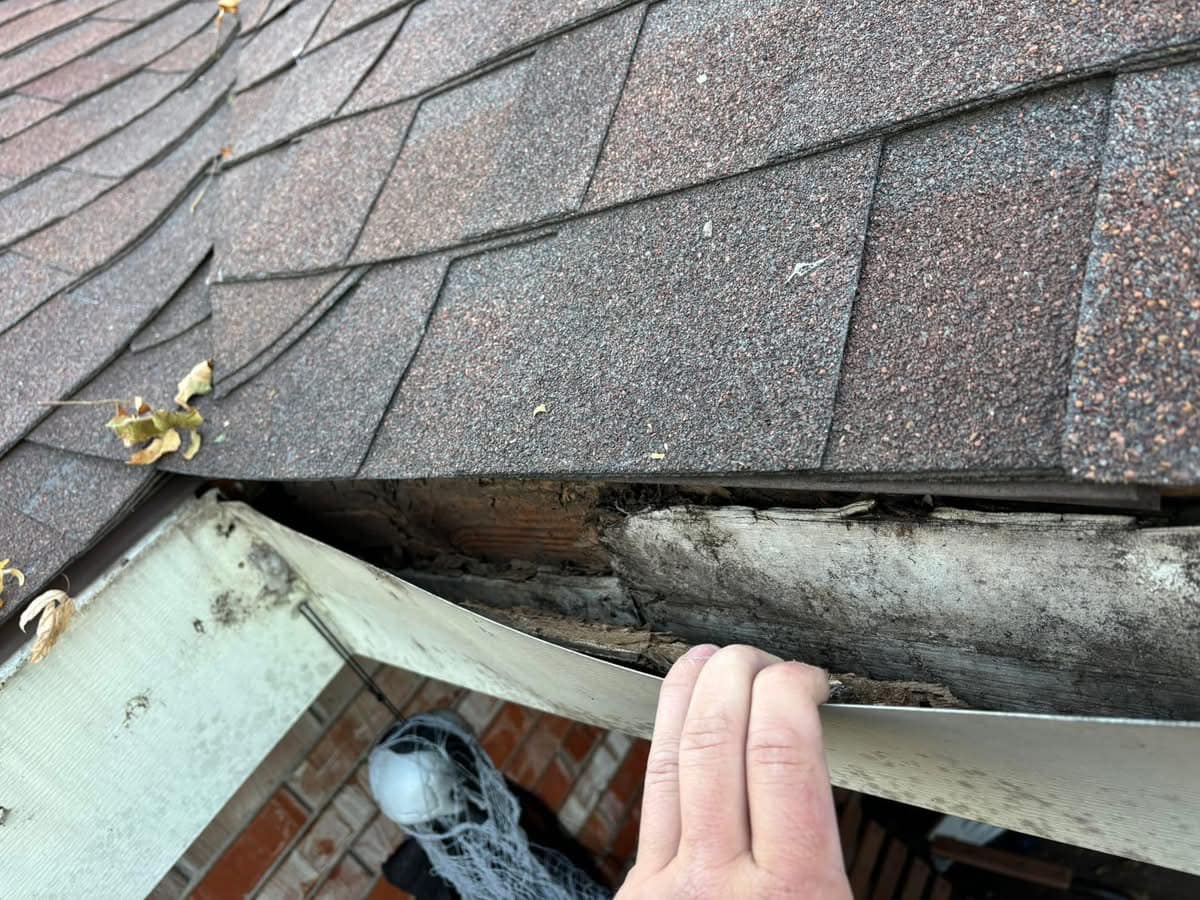

1. Normal Wear and Tear

Over time, gutters deteriorate due to exposure to rain, snow, and debris. If your gutters are sagging or rusted because of age, insurance will not cover the replacement.

2. Poor Maintenance

If your gutters clog and overflow because you didn’t clean them regularly, your insurance won’t help. Homeowners are expected to maintain their gutters to prevent water damage.

For example, if clogged gutters lead to foundation damage or interior water leaks, your insurance company might reject your claim, citing negligence.

3. Improper Installation

If your gutters were not properly secured and fall off during a windstorm, your claim may be denied. Insurance companies expect homeowners to install gutters correctly or hire professionals to do the job.

Factors That Affect Gutter Repair Coverage in Middlebury, Indiana

Insurance policies vary based on your coverage limits, deductibles, and provider terms. Here’s what you should consider:

1. Policy Type

- HO-3 Policies: This is the most common homeowners insurance policy and covers most perils except those specifically excluded.

- HO-1 & HO-2 Policies: These provide more limited coverage, so review your policy carefully.

2. Deductibles

Even if your insurance covers gutter damage, you may still have to pay a deductible before coverage kicks in. If your repair costs are lower than your deductible, it may not be worth filing a claim.

3. Coverage Limits

Your policy will only cover damage up to a certain amount. If your coverage limit is low, you may need to pay out of pocket for part of the repairs.

How to File an Insurance Claim for Gutter Repairs

If your gutters are damaged by a covered event, follow these steps to increase the chances of a successful insurance claim:

Document the Damage

- Take clear photos of the damaged gutters.

- Note the date and cause of the damage.

Contact Your Insurance Provider

- Call your insurance company as soon as possible.

- Provide them with evidence of the damage.

Get a Professional Inspection

- Some insurance companies require an inspection before approving a claim.

- A contractor or insurance adjuster will assess the damage.

Review Your Policy

- Check your policy’s coverage terms, limits, and exclusions.

- Make sure the damage is caused by a covered peril.

Proceed with Repairs

- If approved, your insurance will either pay the contractor directly or reimburse you after the repairs.

Preventative Measures to Avoid Gutter Damage

Since insurance doesn’t cover wear and tear, it’s essential to maintain your gutters properly. Here’s how:

- Clean Gutters Regularly: Remove leaves and debris at least twice a year.

- Install Gutter Guards: Prevents clogs and reduces maintenance.

- Secure Loose Gutters: Make sure they are properly fastened to your home.

- Trim Overhanging Trees: Prevents branches from falling and causing damage.

- Inspect Gutters After Storms: Check for any signs of damage after severe weather.

Don’t Let Clogged Gutters Cost You More! Schedule Your Cleaning Today

Protect your home by ensuring your gutters are in top shape before the next storm hits! If you’re unsure whether your homeowners insurance covers gutter repairs, now is the time to review your policy. Contact a local expert in Middlebury, Indiana, like SmartStyle Seamless Gutters for a professional inspection and guidance on filing a claim. Don’t wait until it’s too late, schedule your gutter maintenance or repair today!

FAQs About Insurance and Gutter Repairs in Middlebury, Indiana

Does homeowners insurance cover gutter replacement?

Yes, but only if the damage is caused by a covered event, such as a storm or fire. It won’t cover replacement due to old age or lack of maintenance.

How much does it cost to repair gutters in Middlebury, Indiana?

Gutter repair costs range from $150 to $600, depending on the damage. Full replacement can cost $1,000 or more.

What should I do if my insurance claim is denied?

If your claim is denied, you can:

- Request a detailed explanation from your insurer.

- Provide additional documentation (photos, contractor estimates).

- Appeal the decision if you believe the denial was unfair.

Can clogged gutters cause insurance claims to be denied?

Yes. If gutters were clogged before the damage occurred, your insurance may deny the claim, citing poor maintenance.

Should I repair or replace my gutters after storm damage?

It depends on the extent of the damage. If only a small section is affected, a repair may be enough. If multiple sections are damaged, a gutter replacement might be a better investment.

Will my insurance cover gutter damage if a neighbor’s tree falls on my house?

Yes, in most cases. If a tree from your neighbor’s yard falls on your home and damages the gutters, your insurance will typically cover it. You may also be able to file a claim with your neighbor’s insurance if the tree was dead or poorly maintained.

Will my insurance pay for new gutters if I upgrade them?

No, insurance only covers damage repairs, not upgrades. If you want to install new gutters with better materials, you’ll need to pay out of pocket unless they’re replacing damaged ones.

Can I file a claim for gutter repairs if I have a high deductible?

It depends on the cost of repairs. If your deductible is higher than the repair cost, filing a claim may not be worth it. Always compare the repair estimate to your deductible amount before deciding.

Can I get coverage for gutters if they were installed improperly?

No, homeowners insurance does not cover issues caused by faulty installation. If your gutters were not secured properly and fell off, you’ll need to pay for repairs yourself.